Patient Financial Services | Cookeville Regional Medical …

13 hours ago o Count any amount you pay for emergency services or out-of-network services toward your in-network deductible and out-of-pocket limit. If you think you’ve been wrongly billed, please call Cookeville Regional Medical Center’s Financial Services at 931-783-5350. You may also contact the federal No Surprises Help Desk at 1-800-985-3059. >> Go To The Portal

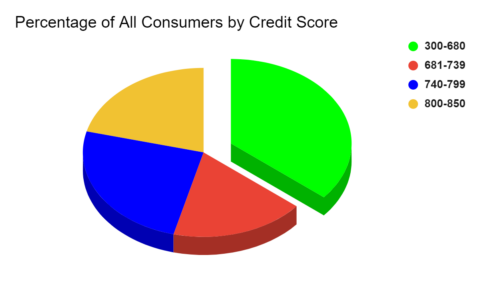

How does patientfi check a consumer’s credit score?

With patient’s authorization, PatientFi checks the patient’s credit report. Generally, when a consumer applies for credit, checking a credit report typically influences a consumer’s score. In most cases, a single credit inquiry is unlikely to play a significant role in materially lowering a consumer’s credit score.

How do I contact CRMC patient financial services?

By mail: CRMC Patient Financial Services 1 Medical Center Blvd.,Cookeville, TN 38501 By phone: 931-783-2360 In person: Pay in person at our location on 140 West 7th St. in Cookeville or at the cashier window in the North Patient Tower by Registration.

How do I make a payment to patient financial services?

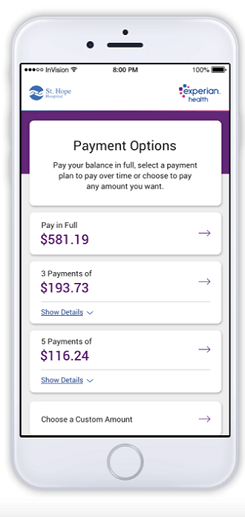

Patient Financial Services Make A Secure Payment Here Patient Financial Services wants to make it as easy as possible to for you to pay your account. Payments can be made online at this site, via mail or over the phone.

What is patient financial clearance?

With Patient Financial Clearance, your staff accesses the most accurate financial data to screen patients for Medicaid, charity or other assistance programs. Our solution can be used prior to service or at the point of service, and can also evaluate payment risk to determine the most appropriate collection policy.

How do you get medical collections off your credit report?

File a credit dispute. ... Pay off your medical collection. ... Bring your medical debt below $500. ... Ask your health insurance company to pay the debt. ... Ask for a goodwill deletion. ... Settle your medical debt with pay for delete. ... Hire a credit repair company.

Can hospital bills go on your credit report?

Unpaid medical bills may be sent to debt collectors, at which point they may show up on your credit reports. Collections accounts can take up to seven years to drop off your credit reports, although the impact on your credit score will lessen over time.

Can paid medical collections be removed from credit?

Starting July 1, 2022, medical debt that's been paid will no longer be included on credit reports from Equifax, Experian and TransUnion—even if it's been on your report for several years.

Is it a HIPAA violation to have medical bills on credit report?

HIPAA does not regulate credit reporting of medical bills. The FCRA does. And the FCRA does not allow deletion of reported debt even in the case of a HIPAA violation. But the creditor may be willing to delete the reporting if you threaten to sue them for violating the law.

How long does medical debt stay on credit report?

seven yearsOnce reported to your credit bureau, medical debt remains on your credit report for seven years, which is as long as any other collection debt.

Can medical debt be forgiven?

How does medical bill debt forgiveness work? If you owe money to a hospital or healthcare provider, you may qualify for medical bill debt forgiveness. Eligibility is typically based on income, family size, and other factors. Ask about debt forgiveness even if you think your income is too high to qualify.

Can unpaid medical bills ruin your credit score?

Medical bills will not affect your credit as long as you pay them. However, medical debt is handled a little differently than other types of consumer debt. Since most health care providers don't report to credit bureaus, your debt would have to be sold to a collection agency before appearing on your credit report.

How many points will my credit score increase when I pay off collections?

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law's editorial disclosure for more information.

How can I get a collection removed without paying?

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

What medical information is allowed on a credit report?

These disclosures, however, are limited to the following protected health information about the individual: name and address; date of birth; social security number; payment history; and account number.

Can medical debt go to collections?

If the medical bill is yours, it is accurate, and you owe the money, then debt collectors can contact you to try to collect it. They may sue you to recover the money—and if they win the lawsuit, they could garnish your wages or place a lien on your home.

How long does a hard inquiry stay on your credit report?

Unlike soft inquiries, hard inquiries negatively affect your credit score and remain on your credit report for 2 years.

What is a soft inquiry?

A soft inquiry is when someone checks your credit report for any number of reasons (renting an apartment, obtaining a job, etc.) and does not affect your credit score. When you apply for a PatientFi loan, we perform a soft inquiry for you to check your rate.