MEDIPLUS® TRICARE Supplement Insurance Plan

1 hours ago The Military Officers Association of America (MOAA) is the country's leading organization protecting the rights of military servicemembers and their families. Those who belong to MOAA not only lend their voices to a greater cause, but they also gain access to extensive benefits tailored to the needs and lifestyles of military officers. MOAA members proudly hail from every … >> Go To The Portal

What are the benefits of a MOAA health plan?

The Military Officers Association of America (MOAA) is the country's leading organization protecting the rights of military servicemembers and their families. Those who belong to MOAA not only lend their voices to a greater cause, but they also gain access to extensive benefits tailored to the needs and lifestyles of military officers. MOAA members proudly hail from every …

How do I fill out a Mediplus claim form?

5. If your claim for benefits is under the MOAA Hospital Income Plan, send a copy of the hospital bill showing admission and discharge dates. 6. Mail Claims to: MOAA Insurance Plans Attn: Claims P.O. Box 9126 Des Moines, IA 50306-9126 For TRICARE Supplements, if services were provided in a Civilian Hospital, please attach a copy of the

Where can I find information on the MOAA-sponsored Tricare supplement plans?

Number, a brief diagnosis, and the MOAA member’s full name (if the claim is for a dependent) directly on the TRICARE EOB form. *For Pharmacy claims, please see further information under “General Tips” section on page 1. Inpatient Benefits: Complete the MOAA MEDIPLUS claim form . Only one form per patient is necessary

What insurance products are available under the MOAA insurance program?

Mediplus Self-Help Portal; Contact; PROVIDER NETWORK Explore. Explore. EXPLORE. EXPLORE. Explore. Explore. EXPLORE. Join The Mediplus Family. DO YOU WANT TO JOIN OUR PROVIDER NETWORK? Yes! Sign Me Up! [joinForms opt=p] WOULD YOU LIKE TO GET IN TOUCH WITH MEDIPLUS? CONTACT US. VISION STATEMENT.

What is mediplus Moaa?

MOAA MEDIPLUS® TRICARE Supplement Insurance coverage is an affordable solution. It works hand-in-hand with TRICARE coverage for retirees to enhance your overall protection and help pay your covered medical bills. You'll have added coverage for covered hospital stays, doctor visits, prescription drugs and more.

Is mediplus a Tricare supplement?

The MEDIPLUS TRICARE Supplement helps cover cost-shares not fully reimbursed by TRICARE for covered doctor visits, hospital stays, surgeries, prescription drug cost-shares and covered excess charges (up to 15% above the TRICARE allowed amount), once any applicable TRICARE and MEDIPLUS deductibles have been met.

Is Tricare supplement insurance worth it?

While Tricare is a comprehensive insurance plan and allows for flexible healthcare options, it does not cover every expense a military retiree may encounter. Tricare Supplement insurance is a worthwhile investment for Tricare holders who are seeking to reduce out of pocket costs that are left behind by Tricare.

What is MOAA advantage?

Member Benefit BreakdownBenefitsBasicBetter Value PremiumExclusive Discounts on Products & Travel Yes YesAccess to Member Books & GuidesNo YesFinancial Education & Consumer AdviceNo YesScholarships, Interest-free Loans & Grants For children of MOAA members seeking undergraduate degrees.No Yes9 more rows

How do I know if I have Tricare for Life?

Go to the TRICARE Covered Services page. For Medicare services, visit the Medicare website. You can also check out the TRICARE For Life Cost Matrix to see a breakdown of costs for certain Medicare and TRICARE covered services.Oct 1, 2020

What is Tricare Select?

TRICARE Select is a self-managed, preferred provider organization (PPO) plan available in the United States. You must show eligible for TRICARE in the Defense Enrollment Eligibility Reporting System. You need to register in DEERS to get TRICARE.. Enrollment is required, learn more on the Select Enrollment Page.Jan 28, 2021

What happens to TRICARE when I turn 65?

TRICARE and Medicare beneficiaries who are age 65 must have Medicare Part A and Part B to remain TRICARE-eligible and be able to use TFL. TRICARE beneficiaries who aren't eligible for premium-free Medicare Part A at age 65 on their own work history or their spouse's work history remain eligible to enroll in USFHP.

Do you need a Medicare supplement with TRICARE?

TRICARE supplements don't qualify as "other health insurance.", such as a Medicare supplement or an employer-sponsored health plan, you can use TRICARE For Life as long as you have both Medicare Parts A and B.Nov 14, 2019

What doesn't TRICARE cover?

In general, TRICARE excludes services and supplies that are not medically or psychologically necessary for the diagnosis or treatment of a covered illness (including mental disorder), injury, or for the diagnosis and treatment of pregnancy or well-child care.

What is the meaning Moaa?

After a membership vote in September 2002, the association changed its name from The Retired Officers Association (TROA) to the Military Officers Association of America (MOAA), on January 1, 2003.

Is TRICARE for Life Medigap?

(Medigap) coverage is optional. You pay a premium each month. Medigap pays your out-of-pocket costs in Original Medicare. Medicare Part A and Part B, TRICARE For Life provides wraparound coverage which pays your out-of-pocket costs in Original Medicare for TRICARE covered services.

Are Moaa dues tax deductible?

Dues to MOAA are not deductible as a charitable contribution for federal tax purposes. Annual membership dues include a $12 subscription to Military Officer magazine.Aug 5, 2020

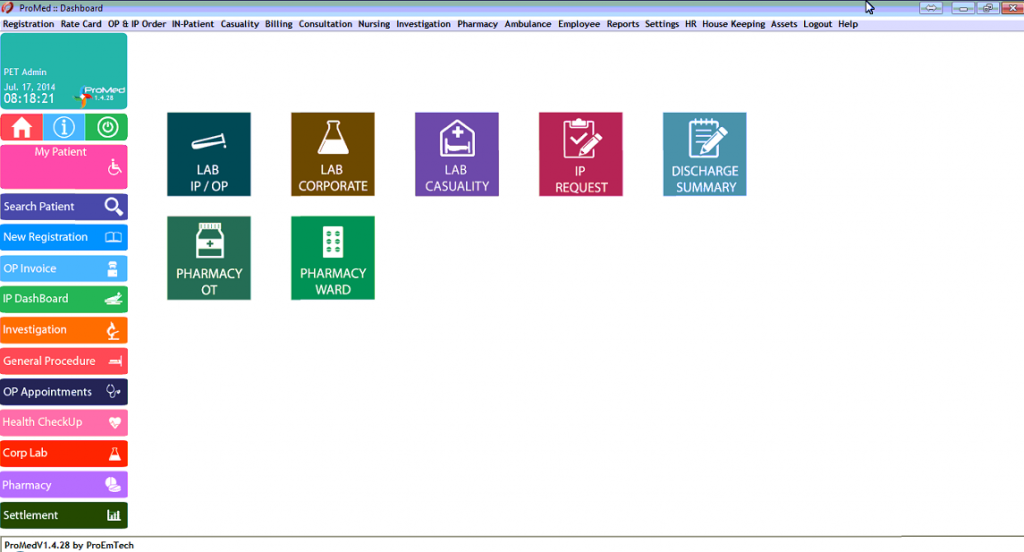

EXPLORE YOUR BENEFITS PORTAL

In a world of uncertainty, there's one less thing to worry about. Securing protection for your family is the first step. Securing enough is the next.

My Account

My Account is managed by Mercer, administrator of MOAA Insurance Plans.

Leader Group Term Life Insurance

Life insurance is one of the cornerstones of financial planning. Let us help make sure your loved ones are taken care of if something happens to you.

Group Level Term Life Insurance

This plan gives you the tools you need to help protect your family’s future. You can select the length of time you need term life coverage (10, 15 or 20 years).

Active Service Discharge Group Term Life Insurance

Officers transitioning from active uniformed service have access to an affordable and guaranteed life insurance option for you and your spouse designed to help replace some of your SGLI coverage.

Group AD&D Plan

Help protect your loved ones' financial future if you are seriously injured or killed in a covered accident.

Hospital Indemnity and Short Term Recovery Insurance Plan

This plan is designed for MOAA members and spouses age 65 and older but under age 100. It can provide benefits to help cover expenses associated with hospitalization and home recovery.